Many people have had to explain new technology to their elderly family members. It’s no surprise that WiFi, social media and bluetooth are now understood, but new topics like cryptocurrency and the blockchain are still confusing.

As a digital-savvy young person, you may be our best option for advice. So take these words from Albert Einstein: “A genius is someone who takes the complex and makes it simple.”

While you don’t need to assume genius status, this post will help you explain CTB or the high tech world of cryptocurrency to your mom or non-techie people.

Ditch all complicated technological terms

Blockchain itself, for instance, is actually just a distributed database or ledger. But even that can be simplified. Skella suggests calling it a record book that is shared. Every block is just a line item to go inside the record book.

The record book is not a physical book. Rather, it exists on many computers around the world, with no central body working to maintain it.

If your mother ever asks you to explain how this whole thing works, say that she has to create a record by sending money to her brother. They send that money using a new line item in the record book. This line item is seen and stored by thousands of other users that confirm the transaction is authorized and legitimate. It’s a bit like having 300 friends watching the pair exchange money.

If money is sent back to your mother, the transactions will be listed as a new line item in your bank account. This is dependent on the same authorization process and will legitimize the problem.

Cryptocurrencies are strictly digital but the future of currency may be in your phone.

I want to speak to all the crypto enthusiasts out there. There’s a lot of talk about coins out there, but no-one is talking about the actual physical coin. In fact, there’s not even one single physical coin that we can call our own. Yet these non-physical coins are still being used as they have a certain value determined by market phenomena such

Fiat currency, used by governments to represent a country’s financial worth, retains value because it’s backed by their finance department. Cryptocurrency has value in that people have a consensus on its worth, respectively.

If I were to summarize it in a sentence, I would say that if something is rare and desirable then it becomes valuable. Just look at Superman comics- they used to cost 10 cents, but we’ve seen them go up in value and worth by $3 million in just a few years.

The more people want a cryptocurrency, the higher its value. That’s why people use it, because it is safe from forgery and can’t be reversed without reason and agreement, this makes it fast. Some banks are great to use in practice, but fail people in bad situations. For example, if someone is struggling financially or has their account restricted somehow and that’s when they need immediate access to funds the most! Bitcoin wallets never have restrictions like this – users can remain anonymous and send only the information they want. You always stay in control of your wallet – unlike bank accounts.

Wait, What’s Mining?

Lance Ulanoff, a tech expert, believes it is more difficult to explain where cryptocurrencies come from and that they can be found in certain places.

Ulanoff advises taking the “mountain” analogy at this point. There is a place called Mount Bitcoin and miners climb it like mountain climbers. Except miners use computers instead of mining equipment It’s one way to exchange your computing power for Bitcoin. Here, miners work endlessly and hope to be rewarded with a new cryptocurrency that will break into smaller pieces and give them the currency of their choice.

Mining is just using computers to solve math equations, but it’s hard for miners because Bitcoin mining gets progressively more difficult the more people start mining.

CTB What?

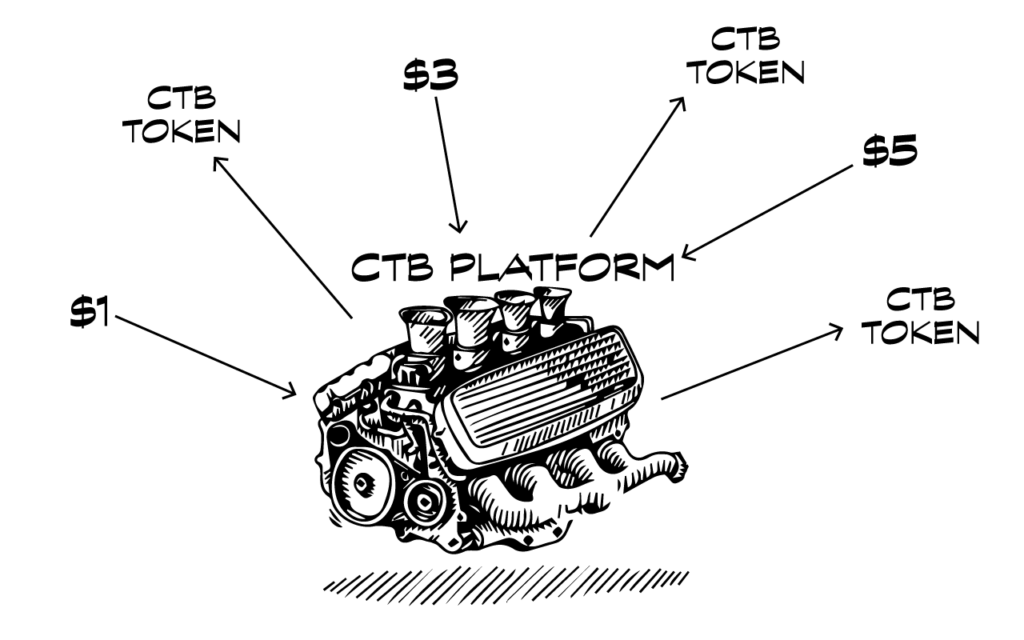

Getting CTB tokens is more like mining. When you get CTB tokens it means you were rewarded for your contribution to a project. In Contrib, tasks are ordered by a project or domain owner where in they use CTB tokens to pay for contributor who will finish those tasks. CTB’s value will always increase as it is used in the platform. This is different from other platforms and quite revolutionary in that, there still has to be a manual approval before your contribution becomes valid. And with that contribution, the value of the project goes up, and CTB tokens goes up as well.

Explaining How Value Works

Gil Gilead at venture capital firm Incentive writes that “one key factor that determines cryptocurrency price is its utility.” The more widely crypto is accepted, the higher its utility and the higher its price.

Supply and demand also affect price, with scarcity driving up its value. This is purposeful and there are only a limited number of coins that will ever be produced. Bitcoin, for instance, has 21 million coins that can be mined with bitcoin software, or bought with other currencies on crypto exchanges.

While most older people are used to the idea of centralized financial institutions and trusted third parties, peer-to-peer cryptocurrency exchanges do not rely on these. The exchange is operated and maintained by software.

So the software gets rid of matching a buyer order with a seller order and connects the buyer to the seller. The intermediary is cut out and, with it, fees.

Machines More Trustworthy Than People

The computer-based authentication makes the system a whole lot more trustworthy.

Risk and technology consultant Joe Ippolito says at Hackernoon that while people have not devised a way to trust one another, they have been able to get machines to trust other machines or networks of machines.

He calls the current epoch “the rise of the ‘economic internet.’” It’s not just that people are spending money online (that’s already happened). It’s “a shift to where the money is baked right into this new iteration of the internet,” which once mainstream “will upend everything we know about the current systems.”

What Are The Risks?

It is essential to point out to any would-be investor what risks are involved with cryptocurrencies.

“The internet is a lawless land, the Wild West still, this new form of gold born on the internet can very much be vulnerable to hackers and thieves, if one is not careful about who they use to get in,” Ippolito writes.

Work is still required to keep inexperienced investors safe, so using trusted crypto services such as Coinbase and established currencies such as Bitcoin, Ethereum and now Binance is a wise strategy. Past fraud has driven down value of the cryptocurrency, but this is becoming less common, Ippolito says. His argument is that the currencies recovered and are stronger for it.

This is something John Biggs, East Coast editor at Techcrunch, picks up on. He writes that it’s a strange time in cryptocurrencies with blockchain technology mature enough that fintechs big and small are using it, yet it is not “trusted enough to become a true store of general value.”

Cryptocurrencies are entering the mainstream but many don’t understand how they work. Biggs says this is not so different from “the NASDAQ with untrained traders making gut-based guesses on complex companies.”

The problem with this approach, he argues, is that “in crypto the technology is wedded to the price and misunderstanding the news coming out of services like CoinDesk can get you into a lot of trouble.”

Biggs provides a short checklist to use with your family members:

- Cryptocurrency will replace how people send money from computer to computer.

- It’s not illegal.

- It’s complex, fascinating, and fun and when it isn’t, it’s time to ditch it.

The Risks Are The Same As With Stocks

Finance writer Stacy Rapacon at the money advice site, Grow From Acorns, says people can lose money with cryptocurrencies in the same way they can when investing in stocks.

“Unlike with individual stocks, you have no real way of evaluating the odds of your investment doing well, and we have little historical data to analyze broader trends — making it tough to determine a fair price to pay or when it’s time to sell,” Rapacon writes.

The lack of regulatory oversight is appealing to some but worrying to others, who argue that as the FDIC does not protect cryptocurrency accounts, they are open to scams.

The advice is to invest responsibly and never more than you can afford to lose. While value of bitcoin has soared in the past, from $800 in January 2017 to $19,000 within 12 months, it also fell by $5,000 in just six days.

“That kind of volatility should be limited to a small portion of your portfolio—the part you’d be okay never seeing again,” Rapacon writes.

But with CTB, the utility token is made to be inflation-resistant since it is pegged to the USD.

CHAD FOLKENING, DOMAIN OWNER, LEAD CONTRIBUTOR

Is Cryptocurrency A Bubble?

Simon Vans-Colina at Medium says when people call crypto a bubble, they’re not wrong. But some bubbles, like the Social Security system, don’t pop. “The money you pay into the government coffers isn’t actually stored until your retirement, it’s used immediately to pay for the care and retirement of current retirees, with the promise that the next generation will pay for yours.”

Bitcoin is immediate and there aren’t any “fundamentals” to end its growth. In November last year, bitcoin is worth $160 billion, which Vans-Colina says is a “pretty useful as a way of storing and transmitting value.’

Cryptocurrencies have been gaining momentum and seem to be more mainstream nowadays. However, some folks are still wary of them, mainly the older generations who may not be as tech-savvy. To get them on board, you should explain crypto in simple terms. and list the pros and cons of using them. In addition, it is important to educate yourself about how cryptocurrencies are mined and what blockchain technology is in order to explain these concepts in more detail.